Bank Overdraft Policy Reform Is Overdue

Quickly – what lending product can charge 10x the average payday loan APR, yet makes up a 4x larger market? Give up? Bank overdraft fees.

That’s right. Nearly five years after federal rules designed to protect consumers went into effect, banks are still raking in the fees. And while strong progress to improve consumer safeguards and combat predatory lending across the board, banks seem to be getting overlooked as the proverbial wolves in sheep’s clothing.

Where Do Overdrafts Come From?

Overdrafts are a relatively new form of short-term credit that is touted by some of the most venerable and respectable financial institutions in the land. An overdraft occurs when a bank or credit union extends credit once an account reaches zero. The overdraft permits the client to continue withdrawing or spending money even when there is no money in the account. Not surprisingly, banks charge a fee for this service.

Banks originally offered clients this service as a courtesy. However, once banks began to adopt automated software to manage accounts, it became easier to provide and charge for overdraft services. As a result, overdraft fees charged by banks doubled from $18 billion in 1999 to $37 billion in 2009. According to an ICBA survey of 200 bankers nationwide, overdraft fees constitute their most profitable non-depository and non-lending product. That is so shocking it’s worth repeating. Overdraft fees are one of the most profitable sources of revenue for banks.

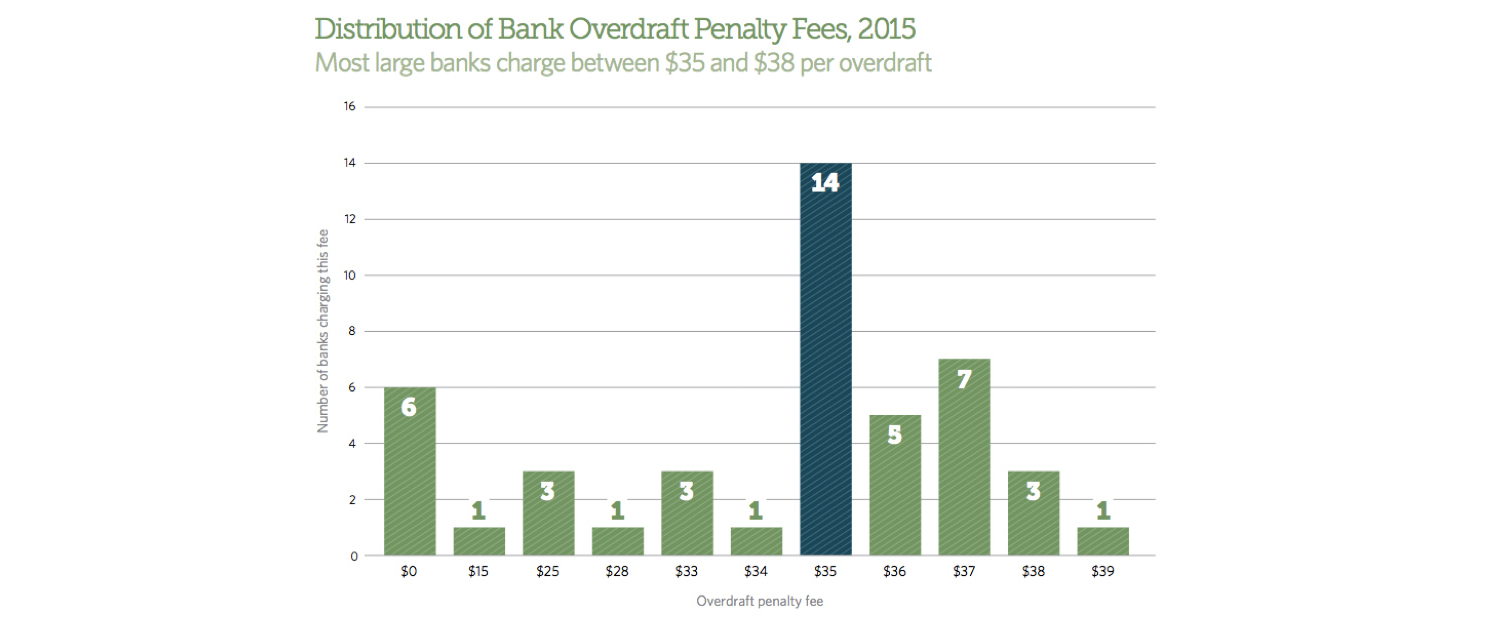

While some consumers are surely pleased that their bank helps avoid hassles and the embarrassment of being declined on a purchase, most would be horrified by the median $34 overdraft fee on purchases of as little as a few dollars.

What Are The Fees On These So-Called Loans?

By calculating overdraft fees as APR, it is obvious that banks are taking unfair advantage of their most unfortunate customers. For example, Fifth Third Bank has a 3,250% APR on a $100 2-week overdraft (courtesy of CreditCards.com). Compared to even an average 339% payday loan APR, that’s outrageous.

Even worse, banks have visibility into their customer’s accounts – enabling them to forecast and plan for income fluctuations while lenders have to do the heavy lifting of underwriting to arrive at and justify their APRs.

Despite these astronomic rates, consumer outrage, calls for change from advocates and federal legislation, the problem continues. According to a recent report by the Pew Foundation, 12 million borrowers spent more than $7 billion on payday loans in 2011. Yet another Pew Foundation survey found that nearly one in five (18 percent) Americans paid overdraft fees in 2011 for a total cost of $32 billion.

Perhaps more troubling is that the Pew survey found that 90% of respondents claim they overdrew on their account by mistake. This means that one of the most profitable sources of income for banks is a type of loan that the vast majority of borrowers don’t even know they took. Say all you want about payday loans — and many of them are pretty awful — but at least you can’t get one by mistake.

So how to respond? While advocates and legislators continue to push on banks, consumers should take matters into their own hands. By understanding the fees and how they work, we can remove the market for banks and take better control of our own finances.

So, What Can You Do?

Here are three easy ways to avoid overdraft fees:

1.) Keep a close look at your account balance. Here are 10 personal finance apps we recommend.

2.) Enroll in an overdraft protection plan that links your checking account to your savings accounts. If your checking account is empty, the bank will automatically transfer funds from your savings account to cover your bills. You’ll still have to pay a fee of around $10, but your checks and debit card purchases won’t bounce.

3.) If you don’t want your account to come with overdraft services, clearly tell your bank or credit union to decline purchases that exceed the money in your account.

I have tried to tell our bank to STOP honoring any purchases which would take the account negative. They say OK but then invariably have loopholes which make the request have practically no effect. They still do the overdraft!