The Challenges of Building A Payday Loan Alternative

Every year, about $50 billion is funneled into the coffers of payday lenders, according to stats from the Online Lenders Alliance. These lenders provide a life-line to approximately 12 million Americans who would otherwise not have access to credit in times of need. The problem is, these loans perpetuate an expensive cycle of fees that trap many borrowers.

Who are payday loan borrowers?

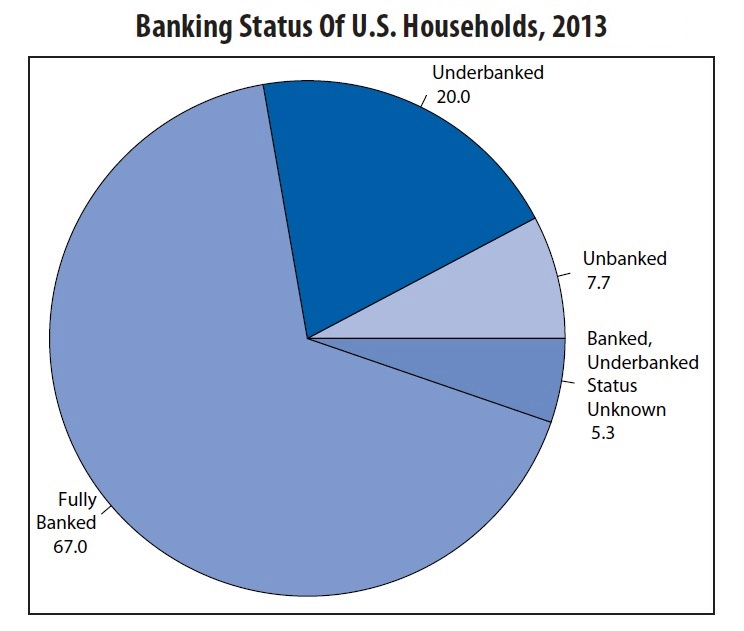

According to the Federal Deposit Insurance Corp.’s latest National Survey of Unbanked and Underbanked Households released October 2014 [PDF] , roughly 34 million households, representing 68 million adults, had limited or no participation in the banking system. According to an earlier survey in 2009, two-thirds of unbanked households use alternative financial service providers to cash checks, provide payday and title loans, issue money orders, and issue pre-paid cards. The FDIC survey indicates that most underbanked households that use alternative financial services do so primarily for convenience, speed of service, and ease in qualifying for a loan.

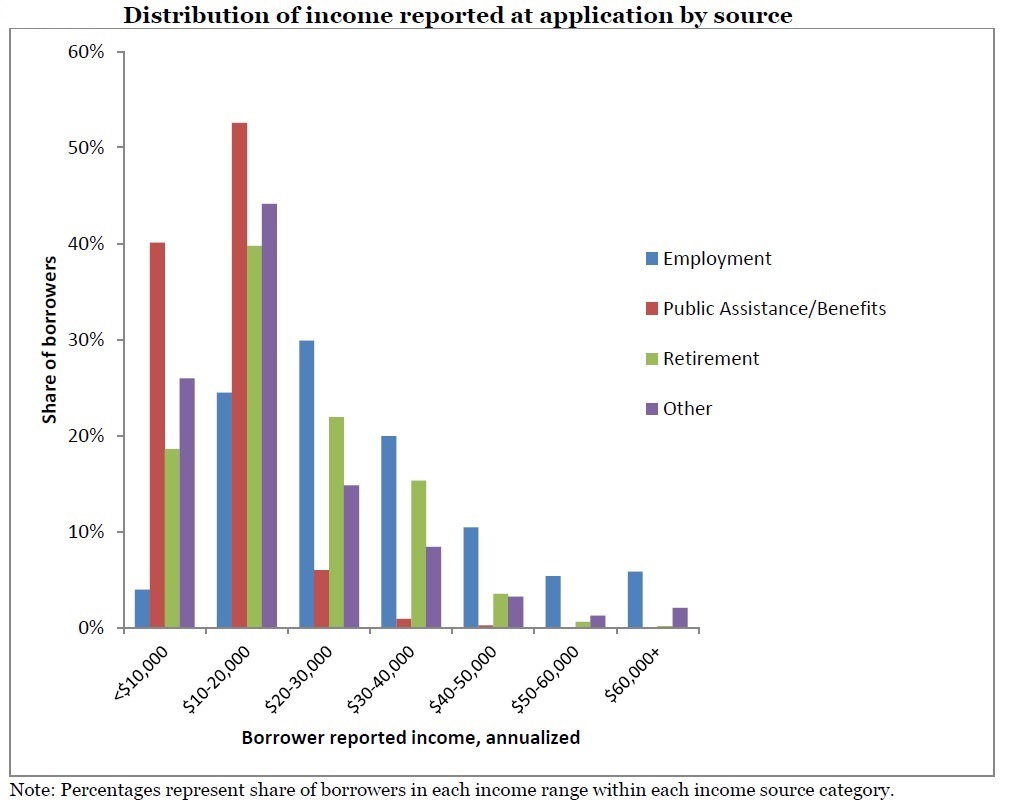

Surveys of payday loan customers find that most are from lower-middle to middle income households. In one survey, about half of the customers reported household incomes of between $25,000 and $50,000. The remaining customers were almost equally divided between those with household incomes under $25,000 and those with incomes over $50,000. This survey also found that payday loan customers tend to be younger than the general adult population and are more likely to have children. They are substantially less likely to have a college degree, although relatively few have less than a high school degree. Over 40 percent of customers report that they own their homes and 57 percent report that they have a bank credit card. Other data sources indicate that over half of payday loan customers are female.

Why do people borrow from payday lenders?

Why do people borrow from payday lenders?

Many payday loan customers apparently do not have access to lower cost credit from banks or credit unions and/or they have “maxed out” their credit cards and other lines of credit. Others do not have access to lower cost credit because they have severely impaired credit histories or do not participate in the banking system. They do not want to ask family members or friends for a cash advance because they might be judged harshly for doing so, or because they have exhausted their access to such informal alternatives. They could address their cash shortfall by making payments using checks that they know will bounce or by delaying paying some bills. But because of substantial fees for late payments, over-limit charges, and NSF and returned check charges, such steps can be even more costly than a payday loan.

As an alternative or supplemental explanation for the use of payday loans, some critics of the product argue that many customers may not understand just how expensive payday loans are. Survey data indicate that at least three quarters of payday loan customers remember to a reasonably accurate degree the dollar cost of the most recent cash advance they received. But when asked what the annual percentage rate (APR) is on their loan, the vast majority of payday loan customers either report that they do not know the APR or they report unrealistically low rates.

A never-ending cycle of debt?

In a traditional payday loan, a customer writes a personal check made out to the lender. The lender agrees to hold the check for a specified period of time, usually until the customer’s next payday or for up to about two weeks, before depositing it. In exchange, the lender advances a cash payment to the customer that is somewhat less than the amount of the check. For example, a borrower might write a check for $115 that the lender agrees to hold for two weeks. The lender provides the borrower with a $100 cash advance. So the borrower pays a $15 fee for a two week finance charge.

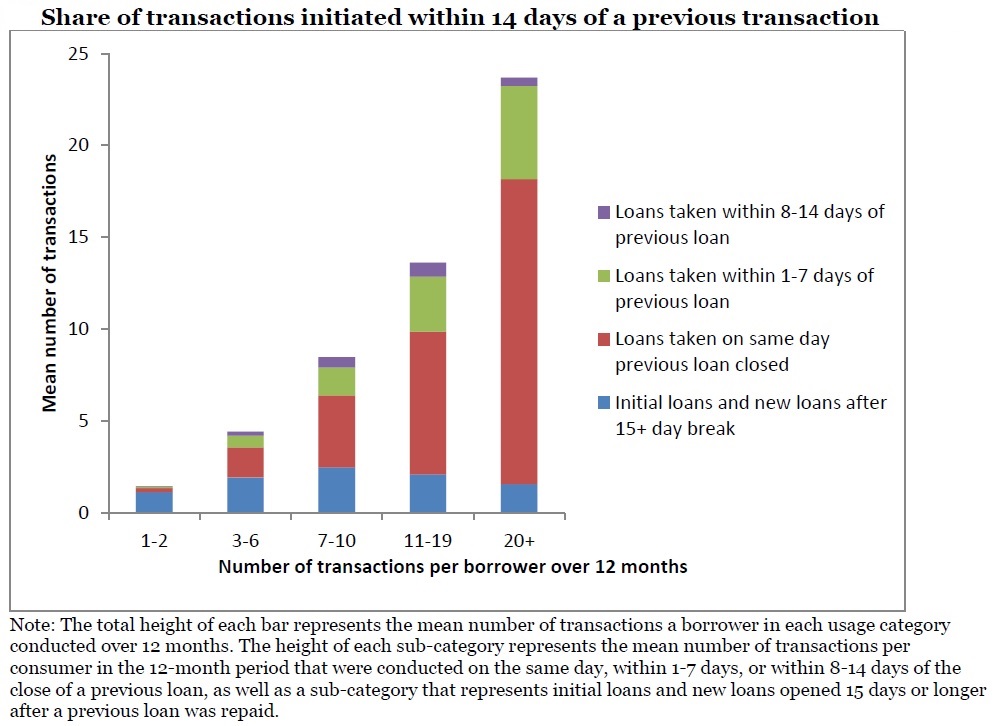

The short two-week repayment periods often make it difficult for borrowers to repay their loans in a timely manner. They often are in the same financial situation they were in two weeks prior. Payday lenders respond by allowing borrowers to “rollover” their loans, essentially creating a new loan with a new fee. According to a 2014 Consumer Financial Protection Bureau report [PDF], four out of five payday loans are rolled over or renewed.

Many borrowers end up in a cycle where they continue to pay a loan fee but do little to reduce their principal. In fact a 2013 CFPB white paper [PDF] indicates the average payday borrower is in debt for nearly 200 days — more than half a year. One-in-four borrowers spends at least 83% of their year owing money to payday lenders. This is on top of any debts that borrower might have to other creditors.

What is the true cost of payday loans?

The true cost of payday loans is somewhat elusive because of the fee-based model. Using the example above, a two-week $100 payday loan may come with a $15 fee. Someone who isn’t savvy with finance might look at that and think the interest rate is 15%. Unfortunately, this is not how APRs work.

When translated to an annual percentage rate, this $15 fee for a two week $100 loan equates to a 390% APR. The industry average APR is 339% according to the CFPB.

A major problem that the CFPB highlights in their report is that it’s unclear whether consumers understand the costs, benefits, and risks of using these products.

Should we place rate limits on loans?

Some states have begun to push back on payday lenders. In 15 jurisdictions across the United States, payday loans are illegal or have annual percentage rates (APR) capped at 36 percent, which is in line with the interest charged by credit card companies for cash advances. These jurisdictions are: Arizona, Arkansas, Connecticut, District of Columbia, Georgia, Maryland, Massachusetts, Montana, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Vermont, and West Virginia.

The federal government has also taken notice, with laws already in place to protect military personnel and proposed legislation to protect all consumers. The Military Lending Act places a maximum limit of 36 percent APR on loans offered to military personnel.

To achieve a 36% APR, the lender would need to limit the fee on a two-week $100 loan to $1.38 – not enough to even cover the origination cost.

Then there is the issue of covering the costs of defaults. Industry statistics indicate 6% of all payday loans default. Seems low? Well remember these are two week loans, so if you had a group of 100 two-week loans and 6 of them defaulted, you would need an annual rate of 156% just to break even on those defaults.

The bigger costs are the marketing and operations costs associated with these loans. Overhead to operate the 20,000 omnipresent storefront locations is the biggest single expense. Lets say that we go really conservative and say between all the marketing and operational expenses it cost a payday lender $5 to get that $100 loan. We would need a 130% APR to cover that cost.

If you combine default costs with your assumed marketing and operations costs we are at a 286% APR just to cover basic expenses (and that doesn’t take into account compounding). In case it’s not yet clear, lending small amounts of money to high risk borrowers for short periods of time is expensive, and therefore so is borrowing that money.

If you look at the annual reports of big payday lenders you’ll see that they actually operate at pretty low margins..

A more competitive marketplace would likely bring the price meaningfully below $15 per $100 loaned, but 36% APR would be unsustainable for the current payday lending model as we know it today.

Ultimately, this means 36% APR caps would undoubtedly push many borrowers with poor or nonexistent credit histories even further out of the credit system.

States that eliminate payday loans immediately experience a substantial rise in costly outcomes to consumers, according to research at the Federal Reserve Bank of New York and Kansas City Fed. These studies also find that more households file for bankruptcy when payday loans are no longer available.

Hence, trying to focus purely on interest rate caps is probably a short sighted way to regulate the industry. Fostering competition will introduce better alternatives, while providing access to credit to those that need it.

New and innovative lenders like LoanNow will organically drive down interest rates through more sustainable installment products, operational efficiency, better underwriting models, risk-based pricing, and improved risk management.

It’s pretty simple. If you spend less money on overhead, your underwriting is smarter and you offer loans only to those who prove creditworthy (which doesn’t necessarily mean those with a high credit score), then your default rate falls and, indirectly, so does your APR.

Do banks deserve some of the blame?

Many lenders, not just payday lenders, ask borrowers to set up automatic payments using Automated Clearing House (ACH) withdrawals. This allows lenders to collect payments from borrowers while providing structure and convenience to the borrower’s repayment cycle.

But for approximately 27 percent of payday borrowers, withdrawals for payday loan payments result in overdrafts to their accounts, according to a 2013 story published in The New York Times. With banks collecting overdraft fees of $20, $25, or $30 for each overdraft, it’s easy to see how payday lending represents a potentially lucrative source of revenue.

On the surface it seems natural to point a finger at lenders for initiating these failed payments. But blaming lenders for payment failures seems a little bit ironic. They are simply trying to collect a payment using a method that was already authorized by their borrower. Furthermore, lenders also have to pay fees for failed ACH payments, not to mention the fact that a high rate of failed ACH payments threatens their banking relationships. Hammering borrower accounts with ACH payments is not something lenders want to do.

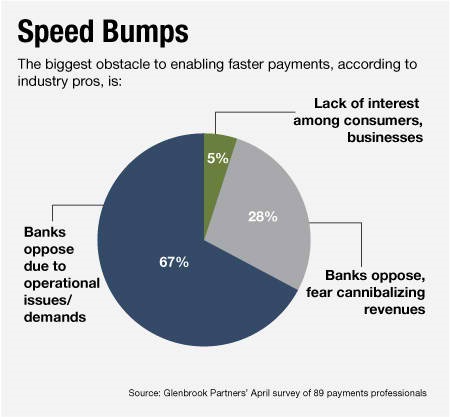

The heart of the problem is that lenders are working within the confines of a system built in the 1970s. Any payment made via ACH also has to clear the Federal Reserve System and their clearing process only runs once per day. This means the overall process can take up to ten days!

Furthermore, there is almost no transparency into the status of the transfer throughout this process. By contrast, when you purchase something with a credit or debit card an authorization is sent out and an approval or denial response comes back in real time. If the purchase authorization fails neither the borrower nor the lender pays fees.

So why don’t lenders just use the debit cards to process payments? Many, including LoanNow, do offer a debit card payment option. But the main problem is that the banks and credit card companies take credit card processing fees for using their network – usually around 3% of the transaction cost. As a lender looking for ways to lower interest rates, it’s hard to do so when you’re sending 3% right off the bat to the banks/networks.

A real-time ACH network with transaction authorizations would undoubtedly resolve the issue of overdrafting borrower accounts. But the value would go far beyond solving lending payment inefficiencies. Families on the verge of missing the deadline for a utility bill payment would benefit. So would companies that must pay vendors right away. In a situation where a worker fails to submit a timesheet on time, the employer could make a speedier direct deposit.

The United Kingdom also used an old system with old pipes, but after years of complaints, eventually moved to a new banking initiative known as the Faster Payments Service, which made money transfers from banks in the U.K. instantaneous. In the U.K., you can even transfer money on Christmas Day and see it right away.

According to American Banker, in 2012 the banking community in the U.S. came together to vote for a plan that would provide same-day service (though still not instantaneous service!). The vote needed a supermajority of 75 percent in favor, and though more than half voted yes, the banks failed to reach a supermajority. The banks were hesitant because of the costs they would incur to upgrade and the inevitable loss of revenue from fewer overdrafts, wire transfers and other incidental fees.

It is clear that the banks are not motivated to fix this problem. The Faster Payments system used in the United Kingdom was not the result of a collective push by the nation’s banks. They were made to do it by the regulators. The Federal Reserve Board can and should mandate improvements. Those improvements should go beyond same day delivery and be modeled after a more secure real time money transfer service.

It is clear that the banks are not motivated to fix this problem. The Faster Payments system used in the United Kingdom was not the result of a collective push by the nation’s banks. They were made to do it by the regulators. The Federal Reserve Board can and should mandate improvements. Those improvements should go beyond same day delivery and be modeled after a more secure real time money transfer service.

Is the SAFE Lending Act short sighted?

In January 2013, Democratic Senators Jeff Merkley of Oregon, Tom Udall of New Mexico, Dick Durbin of Illinois and Richard Blumenthal of Connecticut introduced the Stopping Abuse and Fraud in Electronic (SAFE) Lending Act. The SAFE Lending Act includes four sections:

-

prevent payday lenders from “creating” checks to draw funds from borrowers’ accounts;

-

allow consumers to stop payment on payday loan withdrawals;

-

require lenders to adhere to the laws of states where borrowers live, not the jurisdictions where they are located (which are sometimes overseas);

-

outlaw “lead generators” that claim to be payday lenders but which actually collect borrowers’ information to sell to the highest bidder.

In regards to the sections concerning payments, regulators would be better served attacking the underlying problem of the ACH system already described earlier in this article. If we fixed the ACH system so that lenders couldn’t possibly overdraft an account we wouldn’t have to remove conveniences from all parties in the transaction.

Allowing borrowers to stop payments is a no-brainer. Any lender not doing this does not have their customers interests in mind. At LoanNow if someone can’t make a payment we are empathetic with their situation and will work with them to resolve the delinquency. We want to help get them back on track to rebuilding their credit. It surprises me that this is something that would need to be regulated.

The bill is presently still in Congress.

What about ability to pay?

In March 2014, the U.S. Senate Banking Subcommittee on Financial Institutions and Consumer Protection conducted a hearing to consider lending practices of payday lenders and other alternative financial institutions. One of the issues raised during the hearing was placing an increased emphasis on verifying a prospective borrower’s ability to pay when making lending decisions. This practice would sharply contrast the present policy of many payday lenders of simply depending on the presence of an upcoming paycheck to qualify borrowers for loans.

In a story published in the Los Angeles Times in July 2014, the Consumer Financial Protection Bureau (CFPB) negotiated a $10 million settlement from Ace Cash Express, based in Texas and operating in 35 states across the country. According to the CFPB, Ace actively encouraged customers who were unable to pay off their original loans to take new loans – setting off the cycle of borrowing, falling behind and more borrowing. The CFPB, which itself was created in 2010 as part of financial reform, is considering whether tougher federal regulations are needed to curb predatory payday lending, the Times reports.

Most payday loan companies provide a fixed fee structure that is the same for all borrowers. They know most of their clients are bad risks who will default, so they balance it out with one really high interest rate for everyone.

At LoanNow we use a system called risk-based pricing. We look at every borrower as a unique applicant. Some have made some mistakes but when we look at non-FICO credit indicators they actually look much better. We agree that all lenders should be looking at each borrowers ability to pay. If they don’t, I’m sure we’ll be seeing more people come our way.

Helping the underserved help themselves

“We must all believe in people and their ability to change their own lives.

All people, including the poor, have enormous capacity to help themselves.”

Muhammad Yunus

Nobel Peace Prize Winner & Grameen Bank Founder

At LoanNow, we believe in empowering consumers to rise beyond the cycle of payday loans.

How are we doing this?

-

Positive Psychology – Incentives can motivate desired behavior. We’ve designed a system that allows borrowers to unlock achievements over the course of their loan lifecycle. This system is designed to help our borrowers attain a sense of confidence and self-sufficiency (rather than negative reinforcement).

-

Financial Education – A major obstacle to the payday loan problem is basic personal finance education. We feed timely, accessible articles to educate borrowers on how to establish credit, set savings goals, and adopt good personal financial management practices.

-

Manageable Payments – At LoanNow we do not offer payday loans. LoanNow’s model is to lend larger installment loans over long periods of time. This gives borrowers more of cushion while putting them on a structured plan of smaller installment payments. On our end, the arrangement fee becomes negligible as a percentage of the loan.

-

Lower APRs Through Operational Efficiency – LoanNow is a technology-driven, online-only lender that does not have the debilitating operating costs that traditional brick and mortar payday loan shops do. These costs can eat up 80% of payday lenders expenses. Operational efficiency is helping us drive down APRs.

-

Lower APRs Through Better Underwriting – Unlike payday lenders who lend to anyone with an income, LoanNow is a risk-based lender with a team of engineers who are innovative in the underwriting and risk management spaces. When evaluating a credit application, we look beyond a borrower’s credit score to evaluate his or her entire financial situation. This helps us reduce APR significantly compared to payday lenders.

-

Credit Building Opportunity – Payday lenders generally do not help you build any credit history. At LoanNow, responsible borrowers improve their LoanNow credit scores to qualify for better rates on subsequent loans. Additionally we are actively integrating with major credit bureaus so that we can report back positive repayment history.

-

Transparency & No Hidden Fees – LoanNow makes transparency a key part of the loan application experience. APRs are clearly disclosed in any loan offer or agreement. Our APRs are of course much lower than payday loan averages. We have no hidden fees or traps.